superpowers?

B2B SaaS Financial Model (Template Included)

Discover B2B SaaS Financial Model with our comprehensive guide and get your free template today!

You can find the template download link in the middle of this blog

Navigating the complex terrain of business finance, especially when raising a new funding round, hinges on having a robust financial model. It's one of the pivotal cornerstones, not just for securing investment but also for the smooth running of your business.

This blog post introduces streamlined, user-friendly tools essential for both securing investments and daily operations. Just input a few details, and let the Excel formula magic handle the rest.

This blog post will guide you through:

- Understanding B2B SaaS Financial Models

- Using the 'Simple Seed B2B SaaS Model' Template

- Understanding Key Financial Metrics

Understanding B2B SaaS Financial Models

Financial models are more than just spreadsheets with numbers. In the B2B SaaS industry, they are essential tools that help you understand how your business is performing, where it's heading, and what changes you might need to make to grow and succeed. A good financial model gives you a clear picture of your revenue streams, expenses, profits, and cash flow.

Specifically, in B2B SaaS, these models focus on recurring revenue, customer acquisition costs, churn rates, and other key metrics unique to the subscription-based business model. Understanding these elements is crucial for making informed decisions, from setting prices to planning for growth.

Now that we've covered the importance of financial models in B2B SaaS, let's dive into how the "Simple Seed B2B SaaS Model" template can be specifically used for your business's advantage.

Using the 'Simple Seed B2B SaaS Model' Template

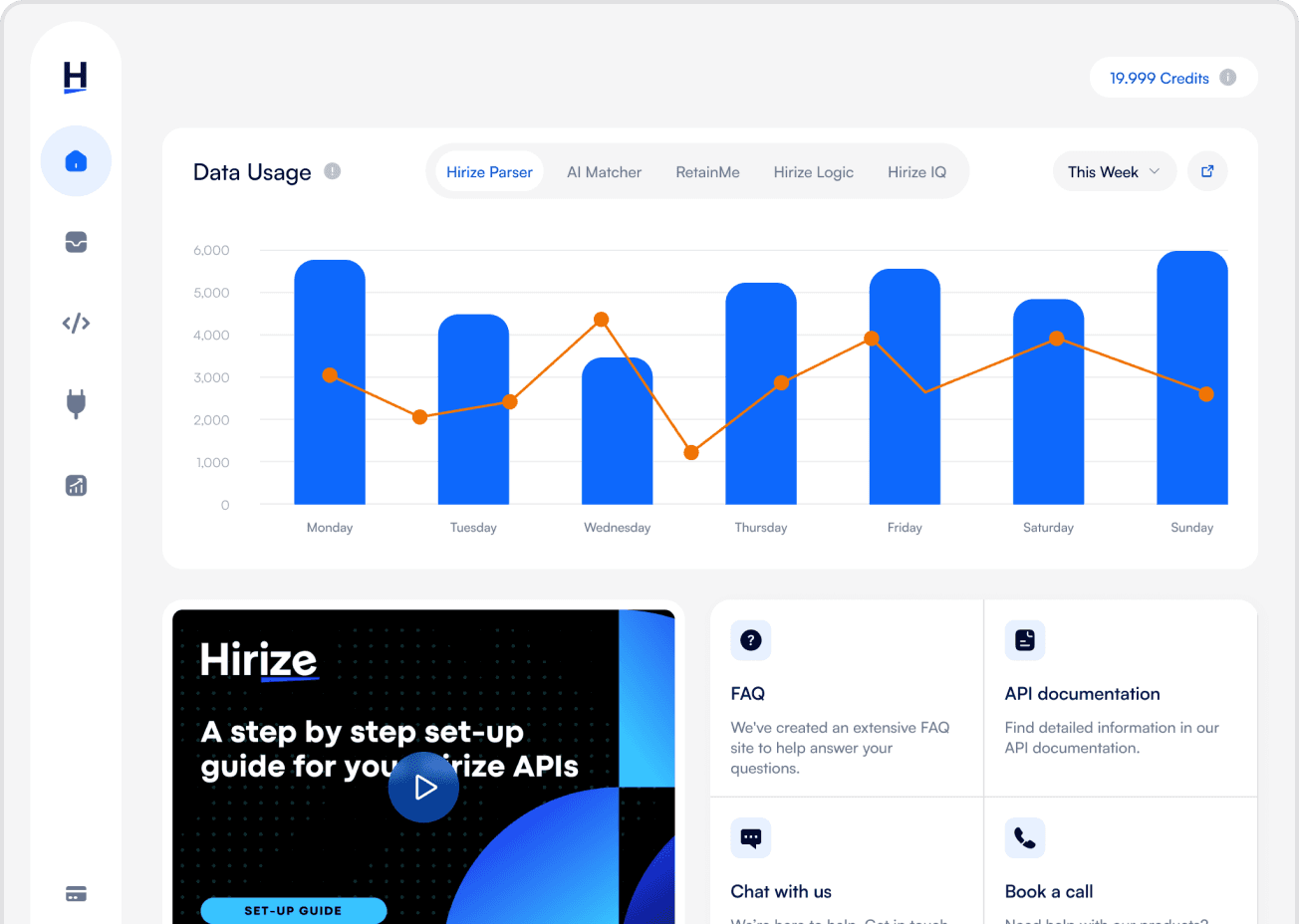

Our 'Simple Seed B2B SaaS Model' template is a powerful tool for any B2B SaaS business owner or financial planner. Our template simplifies complex financial data into a user-friendly format, allowing even those without a deep financial background to make sense of their business's financial health. This model helps you track critical financial metrics over time, giving you insights into the effectiveness of your business strategies.

Here's how you can use each part of the template:

Summary Sheet: This sheet gives you a high-level view of your business's financial health. It summarizes annual performance, showing year-on-year growth and key financial metrics. Use this sheet to quickly gauge your business’s overall financial trajectory.

Monthly P&L & Cash Forecast Sheet: For a more detailed monthly financial analysis, this sheet is invaluable. It tracks your revenue, expenses, and cash flow each month. This level of detail is crucial for understanding monthly trends and making timely adjustments in your business strategy.

Assumptions Sheet: This part of the template allows you to make necessary assumptions for analysis.

In line with supporting startups like yours, we at Hirize present a special offer exclusively for emerging HR Tech startups. Understanding the unique challenges you face, we're offering a significant 60% discount on our startup program. If you're not yet a Hirize customer, this is an excellent opportunity to enhance your startup with our products. Check out the offer!

Next, we'll delve into the key financial metrics included in the template and their significance for your business.

Understanding Key Financial Metrics in the Template

Here's a breakdown of these important metrics that you should keep track of to evaluate your business success:

Revenue: This is the total income generated from your business activities. In a B2B SaaS model, this primarily comes from subscription services. Monitoring revenue helps gauge the market's response to your product and its overall success.

COGS (Cost of Goods Sold): These are the direct costs attributable to the production of the services your business sells. In SaaS, this might include server costs, software licenses, and direct labor. Understanding COGS is essential for pricing your services correctly.

Gross Profit: Calculated as Revenue minus COGS, this metric indicates the profitability of your core business activities before accounting for other operating expenses.

Gross Margin: This percentage (Gross Profit divided by Revenue) shows how much profit you make on each dollar of sales after covering the direct costs of your services.

Operating Expenses: These are the costs required to run your company that aren't directly tied to producing your service, like marketing, salaries, and office expenses. Keeping track of these helps in managing your budget effectively.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric gives you a clear view of your business's profitability by excluding expenses not directly related to your core business operations.

EBITDA Margin: Similar to Gross Margin, this percentage gives insight into the profitability of your business operations but takes into account operating expenses as well.

Monthly P&L (Profit and Loss): This provides a monthly breakdown of your revenues, costs, and expenses, showing the profitability for each month.

Cash Forecast: It projects future cash balances based on your current financial situation. This is crucial for ensuring your business has enough cash to operate and grow.

By keeping a close eye on these metrics using the 'Simple Seed B2B SaaS Model', you can make more informed decisions about how to run and grow your business.

superpowers?